SBP can’t ban what it can’t track. These platforms work in Pakistan through technical workarounds and no-registration models that bypass traditional enforcement mechanisms.

Pakistan’s digital asset traders face technical workarounds amid regulatory uncertainty as centralized crypto currency exchanges remain restricted. The State Bank of Pakistan (SBP) maintains a formal prohibition on cryptocurrency transactions, yet the blockchain-based nature of digital assets enables access to specialized platforms. These cryptocurrency exchange services operate through decentralized protocols, peer-to-peer networks, and non-custodial architectures that process transactions without requiring traditional banking infrastructure or identity verification. This comprehensive guide examines eight platforms offering viable crypto trading solutions for Pakistani users navigating the current regulatory landscape.

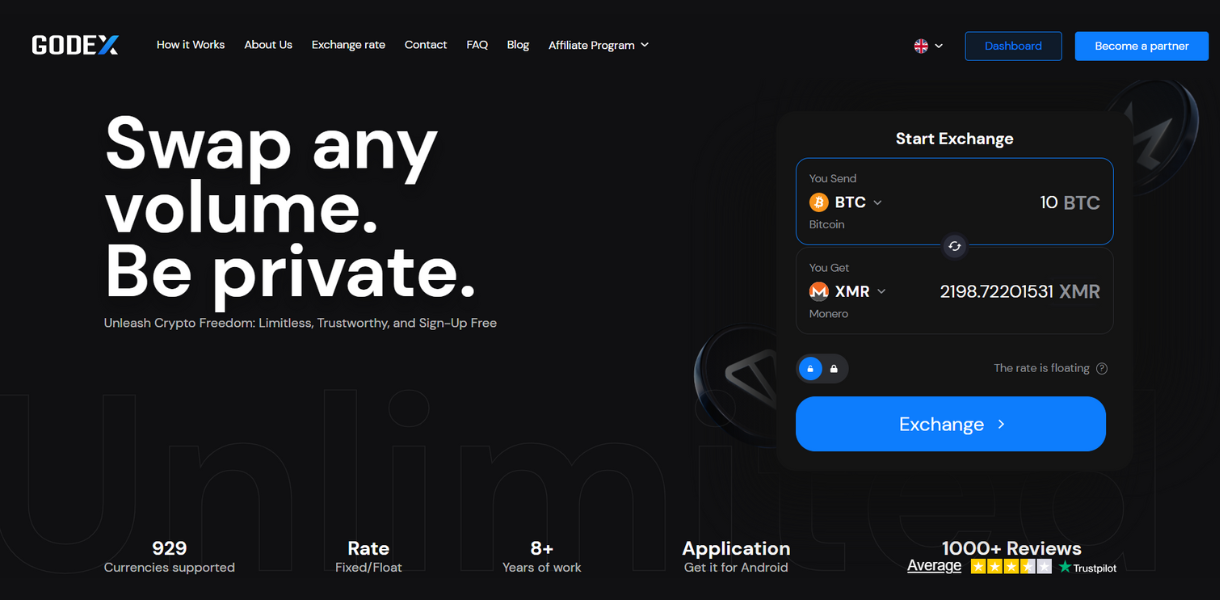

1. GODEX – Privacy-First Cryptocurrency Exchange for Seamless Swaps

GODEX operates as a premier no-registration cryptocurrency exchange platform serving traders worldwide since 2018, offering complete transaction anonymity.

GODEX revolutionizes crypto currency exchange operations by eliminating registration requirements entirely. This Seychelles-registered platform processes wallet-to-wallet swaps for over 910 digital assets across multiple blockchains without collecting personal data. The service aggregates real-time pricing from major platforms including Bitfinex, HitBTC, and Binance to deliver optimal rates. Transactions execute through a straightforward three-step process: users select their cryptocurrency pair, provide destination wallet addresses, and initiate transfers. The platform’s non-custodial architecture means funds never enter GODEX-controlled wallets, minimizing security exposure. Processing times average 5-30 minutes depending on blockchain confirmation speeds. GODEX supports both fixed-rate options (locked for 30 minutes) and floating rates that adjust to market conditions. The absence of KYC procedures makes this crypto currency exchange particularly valuable for Pakistani traders seeking privacy-focused solutions. With 24/7 customer support and an affiliate program offering up to 0.6% revenue sharing, GODEX positions itself as a comprehensive alternative to traditional exchanges requiring extensive verification.

Key Benefits:

- Zero Registration Required: Complete swaps without creating accounts or providing personal information

- 910+ Supported Cryptocurrencies: Extensive selection spanning major blockchains and emerging altcoins

- Non-Custodial Security: Wallet-to-wallet transactions eliminate custodial risks and hacking exposure

- Fixed-Rate Protection: Lock exchange rates for 30 minutes to avoid market volatility impact

- Unlimited Transaction Volumes: No ceiling on exchange amounts, unlike restricted crypto currency exchanges

2. RoboSats – Lightning-Powered Peer-to-Peer Bitcoin Exchange

RoboSats enables private Bitcoin trading through Lightning Network technology without identity verification or account creation requirements.

RoboSats operates as an open-source, privacy-preserving cryptocurrency exchange exclusively accessible via Tor Browser or Android applications. This peer-to-peer platform specializes in Bitcoin-to-fiat currency exchanges using Lightning Network’s instant settlement capabilities. Each trading session generates a unique robot avatar, ensuring trade isolation and preventing cross-transaction correlation. The platform employs hold invoices as escrow mechanisms—temporarily locking Bitcoin payments until both trading parties fulfill their obligations. Trades can complete in as little as 5 minutes when both peers remain online. RoboSats supports all major fiat currencies including Pakistani Rupee (PKR) through various payment methods like bank transfers, mobile money, and cash deposits. The PGP-encrypted chat system protects communication privacy during transaction negotiations. Users post bonds (typically 3% of trade value) to demonstrate commitment, which return upon successful completion. The platform also facilitates on-chain/Lightning swaps and integrates with node software like Umbrel and Start9. Pakistani traders benefit from the absence of geographical restrictions and complete freedom in payment method selection, making this crypto currency exchange ideal for local market conditions.

Key Benefits:

- Tor-Native Privacy: Operates exclusively through Tor network ensuring complete anonymity

- Lightning Network Speed: Complete Bitcoin trades in 5 minutes with minimal transaction fees

- Zero-Knowledge Architecture: No accounts, no data collection, one robot per trade session

- Flexible Payment Methods: Support for any fiat payment method Pakistani traders prefer

- Hold Invoice Escrow: Trustless smart contract protection eliminates counterparty risk

3. lnp2pBot – Telegram-Based Lightning Network Exchange

lnp2pBot transforms Telegram messaging platform into a fully-functional peer-to-peer Bitcoin marketplace powered by Lightning Network technology.

This innovative cryptocurrency exchange operates entirely within Telegram’s ecosystem, requiring only a Telegram username to begin trading. lnp2pBot facilitates direct peer-to-peer Bitcoin transactions using Lightning Network infrastructure, enabling instant settlements with negligible fees. The open-source bot supports 58 fiat currencies including Pakistani Rupee, allowing users to create buy or sell orders with customizable parameters. Sellers pay a flat 0.6% fee covering all network costs, while buyers transact fee-free. The bot employs hold invoices for escrow functionality—Bitcoin remains locked until both parties confirm transaction completion. Community-driven Telegram groups enable localized trading communities where Pakistani users can establish reputation through completed transaction counts and peer ratings. The system maintains strict anonymity by collecting only transaction volumes and rating data, never storing personal information. Users can specify custom price premiums or discounts relative to market rates, enabling flexible pricing strategies. Lightning Network integration means trades bypass traditional banking infrastructure entirely, processing through Bitcoin’s second-layer protocol. Support channels provide assistance through volunteer communities, though response times vary. This crypto currency exchange solution uniquely combines social platform accessibility with decentralized finance infrastructure, making it particularly suitable for mobile-first Pakistani users.

Key Benefits:

- Telegram Integration: Trade directly within familiar messaging app without separate software

- Lightning Network Efficiency: Instant Bitcoin settlements with minimal transaction costs

- Community Trading Groups: Local P2P networks with established trust and reputation systems

- 58 Fiat Currencies: Comprehensive support including PKR for local Pakistani trading

- Open-Source Transparency: Publicly auditable code ensures security and trustless operation

4. SideShift – Multi-Chain Swap Platform with 200+ Assets

SideShift delivers instant cryptocurrency swaps across 200+ digital assets without registration, featuring direct wallet-to-wallet settlement.

SideShift operates as a pioneering non-custodial crypto currency exchange established in 2018, processing over $2 billion in transaction volume through partnerships with Trezor, Bitcoin.com, and Edge Wallet. The platform’s direct-to-wallet architecture eliminates deposit requirements—users initiate swaps that settle immediately to specified addresses. SideShift supports major blockchains including Bitcoin, Ethereum, Solana, Polygon, BNB Chain, and numerous Layer-2 solutions. Traders choose between variable rates (real-time market pricing) or fixed rates (guaranteed amounts for time-limited windows), providing strategic flexibility. The service maintains no user accounts, generating temporary private keys for session management that users may optionally save for staking features. The native XAI token powers an ecosystem offering staking rewards (10%+ APY) funded by 25% of platform revenue. Pakistani users benefit from the complete absence of geographical restrictions and KYC procedures. The platform’s REST API enables developer integrations, while embeddable widgets allow third-party wallet implementations. Cross-chain swap capabilities mean users can exchange assets across different blockchain networks in single transactions. SideShift’s 24/7 support and fast processing (typically minutes) make it a reliable cryptocurrency exchange solution for users navigating regulatory restrictions.

Key Benefits:

- Direct Wallet Settlement: Assets transfer directly to your addresses without platform custody

- 200+ Cryptocurrencies: Extensive multi-chain support spanning major and emerging blockchains

- Dual Rate Options: Choose between variable or fixed rates based on trading strategy

- XAI Staking Rewards: Earn 10%+ APY from platform revenue sharing through native token

- API Integration: Developers can embed exchange functionality into custom applications

5. Coin Swap – Privacy-Focused Bitcoin and Altcoin Exchange

Coin Swap provides straightforward cryptocurrency swaps for Bitcoin, Lightning Network, Monero, Litecoin, and Dash without registration requirements.

Coin Swap operates as a minimalist crypto currency exchange platform focusing on privacy-centric cryptocurrencies. The service specializes in Bitcoin (both on-chain and Lightning Network), Monero (XMR), Litecoin (LTC), and Dash (DASH) swaps. The platform’s lean interface prioritizes simplicity—users select trading pairs, specify amounts, provide receiving addresses, and execute transactions. The website displays real-time daemon status and recently processed exchanges, providing operational transparency. Coin Swap’s emphasis on privacy coins like Monero makes it particularly relevant for users prioritizing transaction anonymity. The platform maintains a straightforward swap model without complex trading features, account systems, or verification procedures. Pakistani traders access these privacy-focused digital assets through a simple, no-frills interface. The service’s lightweight architecture ensures rapid page loads and efficient transaction processing. While documentation remains minimal, the platform’s focus on established privacy cryptocurrencies appeals to users seeking alternatives to mainstream assets. The absence of registration barriers means Pakistani users can immediately access swap functionality without identity disclosure. Transaction fees embed within exchange rates rather than appearing as separate line items. Coin Swap represents a pure utility service—converting one cryptocurrency to another without additional features or complexity.

Key Benefits:

- Privacy Coin Focus: Specialized support for Monero, Dash, and other anonymity-focused assets

- Lightning Network Support: Enable instant Bitcoin transactions with minimal fees

- Minimalist Interface: Straightforward swap process without unnecessary features

- Instant Access: No registration delays blocking immediate trading capability

- Transparent Operations: Real-time status updates showing platform health and activity

6. BitcoinVN – Vietnam’s Premier Crypto Exchange with Global Reach

BitcoinVN serves as Vietnam’s longest-operating cryptocurrency exchange since 2014, offering instant swaps for 98 digital assets including Vietnamese Dong support.

BitcoinVN pioneered Vietnam’s crypto currency exchange landscape and maintains operations accessible to international users including Pakistani traders. This Ho Chi Minh City-based platform enables instant cryptocurrency exchanges across 98 different assets with support for Vietnamese Dong (VND) fiat on-ramps and off-ramps. The founding team includes Vietnamese-German entrepreneurs who established Vietnam’s first Bitcoin ATM network and operate one of Southeast Asia’s largest Lightning Network routing nodes (Top 50 globally). BitcoinVN offers multiple service tiers: instant exchange services, OTC desk for high-net-worth individuals and institutional clients, and Bitcoin ATM locations throughout Ho Chi Minh City. The platform processes exchanges typically within minutes, with bank wire and cash deposit options enabling fiat connectivity. While primarily serving Vietnamese markets, the exchange accepts international users without geographical restrictions. The platform’s reputation spans over a decade of continuous operation, establishing trust through consistent service delivery. Pakistani users can leverage BitcoinVN’s extensive cryptocurrency selection and reliable processing infrastructure. The exchange maintains responsive customer support through WhatsApp and Telegram, providing real-time assistance. BitcoinVN’s commitment to open-source community support and Lightning Network development positions it as a technically sophisticated crypto trading solution.

Key Benefits:

- 11+ Years Operating History: Proven track record since 2014 with sustained reliability

- 98 Cryptocurrency Selection: Comprehensive asset coverage including major and niche tokens

- Lightning Network Leadership: Top 50 global routing node ensuring optimal payment channels

- Multiple Service Tiers: From instant retail swaps to high-volume OTC desk services

- Fast Processing: Typically completes exchanges within minutes with multiple settlement methods

7. Swapuz – Multi-Channel Exchange with 3000+ Cryptocurrencies

Swapuz combines decentralized and centralized exchange features, providing access to 3000+ digital assets through innovative multi-channel routing technology.

Swapuz emerged in 2020 as a revolutionary cryptocurrency exchange platform integrating both DeFi protocols and centralized exchange mechanisms. This multi-channel architecture automatically routes transactions through optimal pathways, creating millions of trading pairs from over 3000 supported cryptocurrencies. The platform’s hybrid approach enables access to assets unavailable on single-source exchanges, bridging CEX and DEX ecosystems. Swapuz offers flexible fee structures with competitive rates and enhanced affiliate programs providing 0.3-0.7% BTC rewards based on referral volume. The service supports both fixed and floating rate swaps, advanced features including limit orders and stop-loss functionality, plus comprehensive portfolio tracking tools. Pakistani users operate through the platform without registration requirements, though larger transactions may trigger automated compliance checks. The non-custodial framework means users maintain asset control throughout trading processes. Swapuz’s technology aggregates liquidity from multiple sources, ensuring favorable rates and minimal slippage across supported assets. The platform processes transactions quickly through optimized routing algorithms, though some users report occasional customer support delays. The extensive cryptocurrency selection makes Swapuz particularly valuable for traders seeking access to emerging tokens and niche blockchain projects not listed on mainstream crypto currency exchanges.

Key Benefits:

- 3000+ Cryptocurrency Support: Unparalleled asset selection spanning major and emerging markets

- Multi-Channel Routing: Hybrid CEX/DEX architecture accessing millions of trading pairs

- Advanced Trading Features: Limit orders, stop-loss functionality, and portfolio tracking tools

- Competitive Fee Structure: Flexible rates with enhanced affiliate earning potential

- Non-Custodial Security: Users maintain complete control over assets throughout swaps

8. Exolix – Instant Cross-Chain Swaps with Enhanced Privacy

Exolix specializes in fast, anonymous cryptocurrency exchanges across 500+ assets with both fixed and floating rate options.

Exolix launched in 2018 as a non-custodial crypto currency exchange prioritizing user privacy and cross-chain functionality. The platform aggregates liquidity from leading exchanges to offer competitive rates across 500+ cryptocurrencies spanning major blockchain networks. Users select between fixed rates (locked for 25 minutes protecting against volatility) or floating rates (real-time pricing potentially offering better execution). The service processes typical transactions in 4-15 minutes depending on blockchain confirmation requirements. Exolix’s architecture ensures wallet-to-wallet settlements—funds never enter platform-controlled addresses, eliminating custodial risks. Each transaction receives unique deposit addresses that expire post-completion, enhancing privacy. The platform’s SSL encryption, DDoS protection, and cold storage policies secure operations while maintaining 24/7 availability. Pakistani traders access Exolix without geographical restrictions, registration requirements, or transaction limits. The service provides comprehensive API documentation enabling third-party integrations. Recent platform enhancements introduced DEX functionality, allowing users to swap crypto through decentralized protocols directly from the Exolix interface. The platform maintains responsive customer support assisting with transaction inquiries. While Exolix reserves rights to request KYC for flagged transactions, routine operations proceed anonymously. The cryptocurrency exchange has established partnerships with institutional wallets like CoinsDo, expanding accessibility through integrated widgets.

Key Benefits:

- Cross-Chain Expertise: Seamless swaps between 500+ assets across major blockchain networks

- Dual Rate Protection: Choose fixed rates for certainty or floating rates for optimal pricing

- DEX Integration: Access decentralized exchange functionality directly through platform interface

- Fast Processing: 4-15 minute average transaction times with 24/7 operation

- API Accessibility: Comprehensive developer tools enabling custom integrations and implementations

How to Choose the Right Crypto Exchange Platform for Your Needs

Selecting an appropriate cryptocurrency exchange requires evaluating specific platform features against individual trading requirements and risk tolerance levels.

Pakistani traders should prioritize platforms offering non-custodial architectures where private keys remain under user control throughout transactions. Evaluate supported cryptocurrency selections—general traders need broad asset coverage, while Bitcoin-focused users may prefer specialized platforms. Consider transaction speed requirements: Lightning Network-enabled exchanges like RoboSats and lnp2pBot process instant settlements, while traditional blockchain swaps may require 10-30 minute confirmation periods. Privacy preferences influence platform selection—services like GODEX and Coin Swap offer maximum anonymity, while others may implement automated compliance screening. Fee structures vary significantly: compare flat fees versus percentage-based charges across typical transaction sizes. For Pakistani users, verify fiat currency support (PKR availability) when planning to convert between crypto and traditional currency. Review customer support availability—24/7 assistance proves valuable when navigating technical issues. Platform longevity indicates reliability—established services like BitcoinVN demonstrate sustained operational capability. Consider additional features including staking rewards (SideShift’s XAI), multi-channel routing (Swapuz), or peer-to-peer flexibility (RoboSats). Always start with small test transactions to verify platform functionality before committing significant capital.

Selection Criteria:

- Non-Custodial Security: Prioritize platforms where you control private keys

- Supported Assets: Match platform offerings to your trading portfolio needs

- Transaction Speed: Evaluate blockchain confirmation times versus instant Lightning settlements

- Privacy Features: Assess KYC requirements and data collection policies

- Fee Transparency: Compare total costs including network fees and exchange spreads

- Customer Support: Verify 24/7 assistance availability in your timezone

Step-by-Step Guide to Making Your First Exchange Without KYC

Execute your initial cryptocurrency swap through privacy-focused platforms using this comprehensive walkthrough designed for beginners navigating no-KYC exchanges.

Step 1: Prepare Your Wallets Establish source and destination cryptocurrency wallets supporting your desired digital assets. For Bitcoin, consider Lightning-enabled wallets like Phoenix or Breez. For multi-asset portfolios, use non-custodial solutions like MetaMask (Ethereum) or Trust Wallet (multi-chain).

Step 2: Select Your Exchange Platform Choose a no-registration crypto currency exchange from the options above based on your specific asset pair and requirements. GODEX offers broadest selection, while RoboSats specializes in Bitcoin-to-fiat trades.

Step 3: Initiate the Swap Navigate to your chosen platform and select your trading pair. Enter the amount you wish to exchange and review the quoted rate. For fixed-rate exchanges, verify the lock duration to ensure completion within the timeframe.

Step 4: Provide Destination Address Copy your receiving wallet address carefully—cryptocurrency transactions are irreversible. Some assets require additional memo/tag information; verify all fields before proceeding.

Step 5: Send Payment Transfer your cryptocurrency to the provided deposit address using your source wallet. Double-check amounts and addresses. Most platforms provide transaction tracking via blockchain explorers.

Step 6: Confirm Receipt Monitor the transaction status through the exchange platform. Upon blockchain confirmation, the swap executes automatically and sends assets to your specified destination address. Processing typically completes within 5-30 minutes.

Understanding Pakistani Crypto Regulations and Safe Trading Practices

Navigating Pakistan’s evolving cryptocurrency landscape requires understanding current regulatory positions while implementing security best practices to protect digital assets.

The State Bank of Pakistan maintains that crypto currency exchange transactions remain prohibited under existing regulations, with the Financial Monitoring Unit referring cases to law enforcement. However, the government simultaneously established the Pakistan Crypto Council in 2025 to explore regulatory frameworks, creating a contradictory policy environment. The Pakistan Digital Assets Authority (PDAA) has been proposed to oversee future regulation and licensing of Virtual Asset Service Providers (VASPs). Despite official prohibitions, blockchain transactions occur outside traditional banking infrastructure, making enforcement technically challenging. Pakistani traders should implement robust security practices: use hardware wallets for significant holdings, enable two-factor authentication on all services, and never share private keys or seed phrases. Conduct transactions through secure internet connections—avoid public WiFi when executing trades. Consider using VPN services to enhance privacy and security, though verify platform policies regarding VPN usage. Start with small transaction amounts to test platform reliability before committing larger sums. Maintain detailed records of all cryptocurrency transactions for potential future tax compliance requirements. The evolving regulatory landscape means staying informed about policy changes through official government channels. Peer-to-peer exchanges and non-custodial platforms offer greater transaction privacy compared to centralized crypto currency exchanges requiring extensive personal data. Pakistani users should prioritize platforms that never touch traditional banking systems, operating purely through blockchain infrastructure. Remember: cryptocurrency investments carry significant volatility risks—only invest amounts you can afford to lose entirely.

Conclusion

Pakistani cryptocurrency enthusiasts can access digital asset markets through specialized platforms circumventing traditional financial infrastructure restrictions. These eight crypto currency exchanges operate through innovative technologies including decentralized protocols, Lightning Network channels, peer-to-peer networks, and non-custodial architectures that process blockchain transactions outside conventional banking systems. While regulatory uncertainty persists, the borderless nature of cryptocurrency networks enables Pakistani traders to participate in global digital asset markets through privacy-focused exchange solutions requiring zero registration. Success requires careful platform selection, robust security practices, and starting with small transaction amounts to verify service reliability before scaling operations.

Frequently Asked Questions

Are cryptocurrency exchanges legal in Pakistan? Pakistan’s regulatory environment remains ambiguous—SBP maintains cryptocurrencies are banned, yet the government established Pakistan Crypto Council to develop frameworks. Non-custodial platforms operating outside banking systems face fewer enforcement mechanisms.

Which exchange offers the best privacy for Pakistani users? GODEX, RoboSats, and Coin Swap provide maximum privacy through zero registration requirements, Tor network access, and non-custodial architectures preventing identity correlation across transactions.

How long do cryptocurrency swaps typically take? Lightning Network exchanges (RoboSats, lnp2pBot) process instantly in 5 minutes. Traditional blockchain swaps (GODEX, SideShift) require 5-30 minutes for confirmation. Exact timing depends on network congestion.

Can I convert cryptocurrency to Pakistani Rupees (PKR)? Peer-to-peer platforms like RoboSats and lnp2pBot support PKR transactions through direct trading with local peers. Instant swap platforms focus on crypto-to-crypto exchanges without fiat conversion.

What are the risks of using no-KYC exchanges? Primary risks include lack of recourse for disputed transactions and potential exposure to illicit fund sources. Mitigate risks by starting with small amounts, using reputable platforms with established track records, and maintaining personal transaction security.

Do these platforms work with Pakistani bank accounts? Most platforms avoid banking integration entirely, operating purely through cryptocurrency blockchain transfers. P2P exchanges (RoboSats, lnp2pBot) enable bank transfers between trading peers, not platform-to-bank connections.

Disclaimer: Cryptocurrency trading carries significant risk. This article provides educational information only and does not constitute financial advice. Pakistani users should understand local regulatory positions and potential legal implications before engaging in cryptocurrency activities. Always conduct thorough research and never invest more than you can afford to lose.